Learn more about partnering with CSA

A majority of Americans are planning a vacation this summer, but did you know that 38% are interested in staying at a vacation rental? Or how many travelers consider issues like the Zika Virus when choosing a destination? Those are just some of the questions answered in a recent survey about summer travel habits, recently released by our 24-Hour Emergency Assistance provider, Generali Global Assistance.

See if these statistics about summer travel plans match what you’re seeing in your business. You may even notice an insightful travel trend you hadn’t seen before!

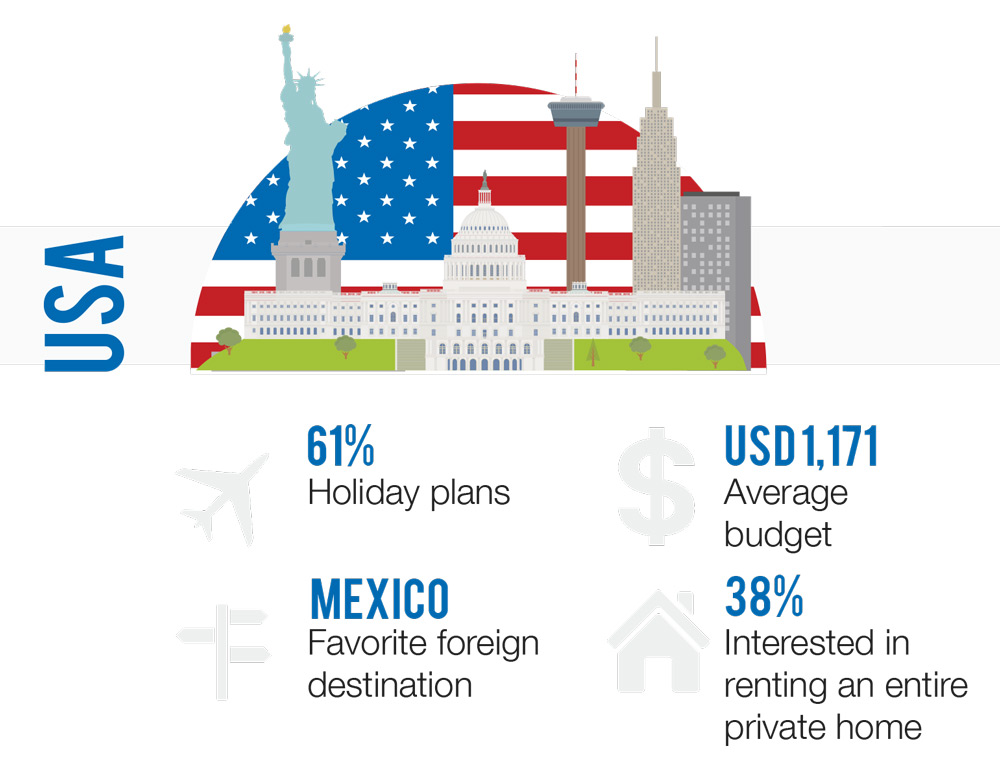

- 61% of Americans intend to go on a trip this summer, for one week (39%) or two (26%).

- The average budget is $1,771. Less than half of Americans consider summer trips to be a category in which they want to cut costs, slightly for 25% or even significantly for 17% of them. However, their intended budget plays a major role in their choice of destination (55%). Opportunities for leisure or cultural activities also play an essential role (52%).

-

27% of Americans consider health risks to be an essential factor in the choice of destination.

- When they think of their ideal vacation, they want to get together as a family, with their spouse or with friends (30%), as well as rest and find peace of mind (21%).

- The seaside (44%) and the city (43%) are the favorite destinations for their summer trips.

- As far as their practices are concerned, the preferred way for Americans to book accommodations is by computer (77%), mainly for the convenience (37%) and also because they usually book this way (21%).

- While 55% intend to book a hotel, 35% would choose to stay for free with friends or family, or at their vacation home.

- They show interest in renting an entire private home (38%) and in renting a room or shared space (20%).

- 35% of Americans would not completely switch off from work during their vacation. Half of them would spend between 30 min and 2 hours per week on it.

Read more about the survey findings

Learn more about partnering with CSA

Note: Conducted by Ipsos at the request of Generali Global Assistance on a sample of 3,000 Europeans (French, German, Italian, Spanish, Belgian and Austrian), the aim of this reference survey — carried out by telephone and published for the 16th year running — is to offer an annual estimate of the vacation plans of the citizens of the countries in question, in addition to their motivations, destinations and preferred types of trips. The 2016 survey was also carried out in the United States and Brazil with a view to comparing practices (samples of 750 individuals surveyed online in each country).

Travel insurance plans are administered by Customized Services Administrators, Inc., CA Lic. No. 0821931, located in San Diego, CA and doing business as CSA Travel Protection and Insurance Services. Plans are available to residents of the U.S. but may not be available in all jurisdictions. Benefits and services are described on a general basis; certain conditions and exclusions apply.

Travel insurance plans are underwritten by: Generali U.S. Branch, New York, NY; NAIC # 11231. Generali US Branch operates under the following names: Generali Assicurazioni Generali S.P.A. (U.S. Branch) in California, Assicurazioni Generali – U.S. Branch in Colorado, Generali U.S. Branch DBA The General Insurance Company of Trieste & Venice in Oregon, and The General Insurance Company of Trieste and Venice – U.S. Branch in Virginia. Generali US Branch is admitted or licensed to do business in all states and the District of Columbia.

Travel insurance plans are underwritten by: Generali U.S. Branch, New York, NY; NAIC # 11231. Generali US Branch operates under the following names: Generali Assicurazioni Generali S.P.A. (U.S. Branch) in California, Assicurazioni Generali – U.S. Branch in Colorado, Generali U.S. Branch DBA The General Insurance Company of Trieste & Venice in Oregon, and The General Insurance Company of Trieste and Venice – U.S. Branch in Virginia. Generali US Branch is admitted or licensed to do business in all states and the District of Columbia.